Get a demo

Select the type of demo you'd like to experience with Indico Data.

Indico’s Agentic Decisioning Platform deploys AI agents purpose-built for underwriting, claims,

and policy workflows—turning messy, unstructured data into fast, auditable decisions.

Use out-of-the-box

or customize

Act with

real-time clarity

Monitor performance

at every step

Platform:

Built for Insurance. Cutting-edge. Trustworthy & Traceable. Easy to Scale.

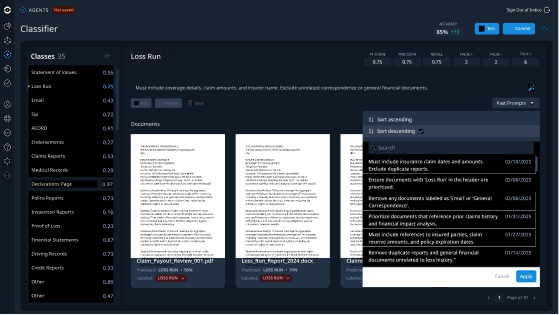

Our agents speak fluent insurance. From loss runs to MRCs, they handle every product line and document type—because they were built for this industry, not retrofitted for it.

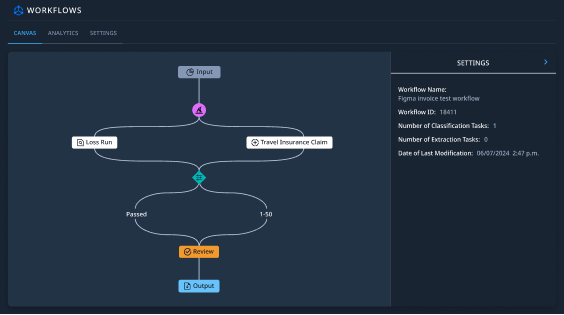

Go live fast with out-of-the-box workflows that reduce manual effort, adapt easily to your processes, and scale across lines of business without slowing you down.

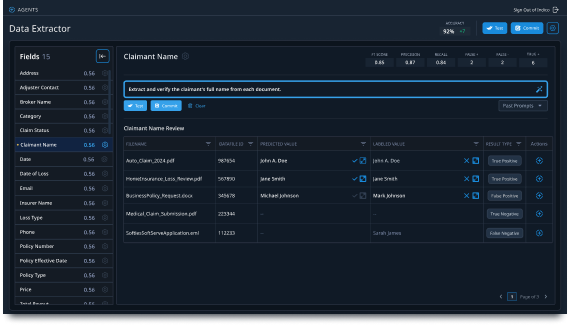

Leverage the power of GenAI that’s fine-tuned for real-world insurance documents, not just shiny demos. Get instant feedback, accurate results and AI-generated summaries that move decisions forward.

No black boxes here. Our traceable outputs are ready for regulators and ensure reliable results without hallucinations.

| Agentic Workflows | Agentic Workspaces |

|---|---|

Built to handle the

|

Real-time insights

|

|

Handle loss runs, apps, MRCs, SOVs, ACORDs, and more |

SME review and feedback built in |

|

Apply field-level validation and audit controls |

Inline document viewer with traceable sources |

|

Configure visually with drag-and-drop simplicity |

Integrated “Next Best Action” decision recommendations |

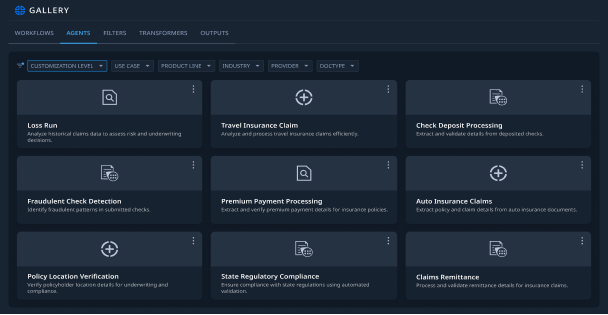

With Indico, you’re not building from scratch. Choose from hundreds of out of the box agents trained on real-world

insurance data, then fine-tune with Agent Studio using natural language- no code, no guesswork.

Out of the Box Agent Examples:

…and hundreds more!

Finally, visibility into the black box. Know what’s flowing in, what’s stuck, and how your agents are

performing—by line, carrier, or document type. Whether you're managing volume, turnaround time,

or accuracy, our dashboard puts actionable insights at your fingertips.