Submission Ingestion

Learn more

Traditional policy servicing is stuck in the past

You're falling behind because the team can’t keep up with demand

You’re risking compliance and customer satisfaction by missing key updates

Your team didn’t sign up to cut and paste from PDFs

You're paying skilled talent to chase documents and fill out forms

We take the admin burden out of servicing, so your

team can focus on delivering timely, accurate support

Move from days to

minutes on policy changes

and endorsements

Handle more requests

without growing your team

Reduce errors and

ensure critical updates

aren’t missed

Eliminate manual data

entry and repetitive

tasks

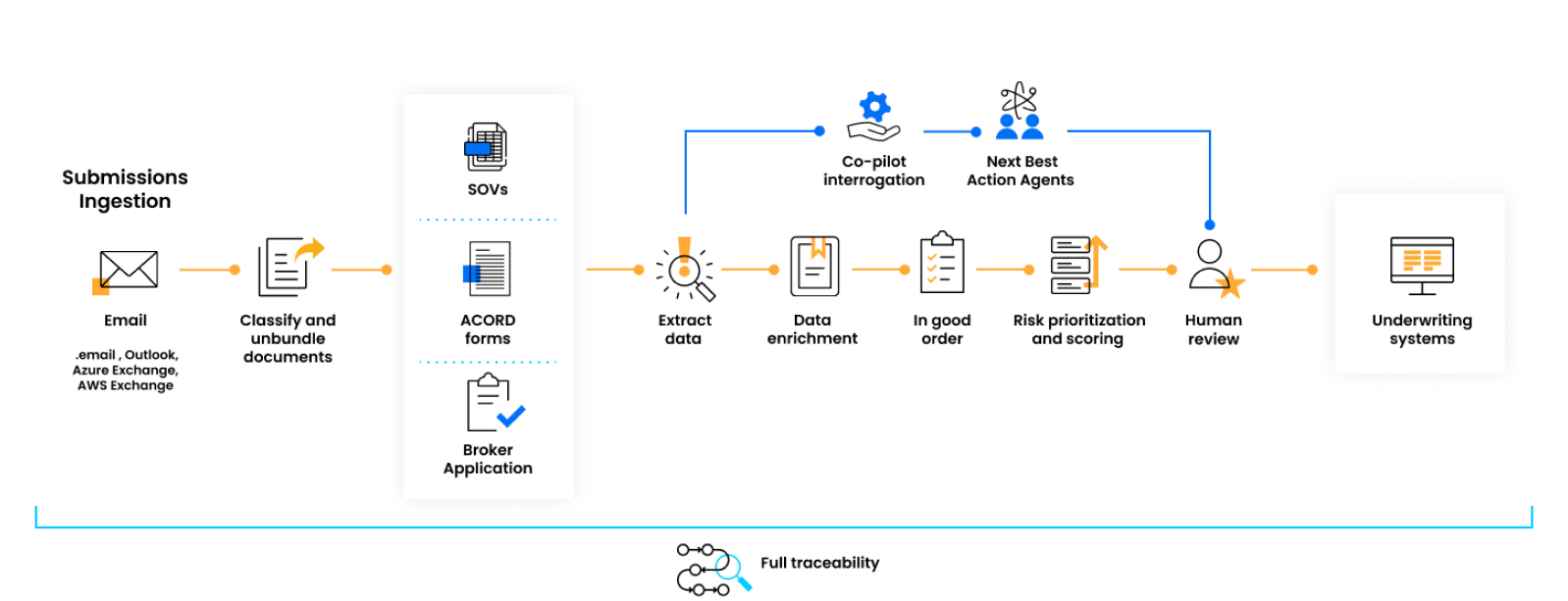

Turn time-consuming submissions handling into a seamless, automated experience that enables faster, more informed underwriting decisions.

Get fast, accurate risk insights. Our automated clearance solution unifies data, scores opportunities by risk appetite, and streamlines decision-making to identify the

best business to write.

Automate data ingestion from any source and see it in one place. With an advanced queue system, auto-decline features, and Agentic AI, get next best action recommendations, boost capacity, and process more submissions for increased premium growth.

Gain confidence with seamless human-AI collaboration and full auditability. Co-pilot features like 'ask my document' simplify document interrogation, ensuring easy access for validation and reducing errors.

Organize and compile incoming data from any source and in any format to create and manage submissions with ease. Get a complete and accurate view of all key information and documents in one place, ensuring your team can track progress and distribute work seamlessly.

Review and resolve any missing or conflicting details in your submission summaries. Leverage AI-driven questioning to extract answers from your documents and easily validate or correct data with direct links to source information.

Receive AI recommendations for next best steps, ensuring optimal decision-making and efficiency. Track submission progress with real-time checklists and prioritize opportunities based on value risk appetite.

Enhance your team’s decision-making power with AI that complements, not replaces, human expertise. Our solution streamlines data processing and analysis, allowing your underwriters to focus on strategic decisions that drive better business outcomes.

Build workflows quickly with the click of a mouse without the need for a technical expert to be involved.

Understand and categorize new data types automatically without needing lots of specific examples beforehand.

Build custom classification & extraction models effortlessly by simply highlighting text.

Stay ahead with our future-proof AI, ensuring you're never stuck with outdated technology, while keeping your data safe.

Build workflows quickly with the click of a mouse without the need for a technical expert to be involved.

Understand and categorize new data types automatically without needing lots of specific examples beforehand.

Build custom classification & extraction models effortlessly by simply highlighting text.

Stay ahead with our future-proof AI, ensuring you're never stuck with outdated technology, while keeping your data safe.

Build workflows quickly with the click of a mouse without the need for a technical expert to be involved.

Understand and categorize new data types automatically without needing lots of specific examples beforehand.

Build custom classification & extraction models effortlessly by simply highlighting text.

Stay ahead with our future-proof AI, ensuring you're never stuck with outdated technology, while keeping your data safe.

Build workflows quickly with the click of a mouse without the need for a technical expert to be involved.

Understand and categorize new data types automatically without needing lots of specific examples beforehand.

Build custom classification & extraction models effortlessly by simply highlighting text.

Stay ahead with our future-proof AI, ensuring you're never stuck with outdated technology, while keeping your data safe.

Our solution is the perfect pair, combining Generative and Discriminative AI. This empowers customers to scale across many use cases and document volumes while providing the best performance at optimal cost.

Indico Data is at the forefront of the latest AI developments. Our Enso project is constantly ahead of bleeding-edge research with the top institutions in the world, ensuring our customers are not only cutting-edge today, but are future proofing for tomorrow.

By design, our solution is a transactional system, meaning we never retain your data, safeguarding you from leakage concerns.

Unlock the combined power of Intelligent Insights and Intelligent Intake in your underwriting process with the Al-driven Underwriting Clearance Solution. This industry-leading combination empowers underwriters, giving them actionable insights and streamlining clearance to improve combined ratios, increase premiums written, and drive better decisions.

Indico Data can process structured, semi-structured and unstructured data with precision.

Indico Data can automatically ingest all common document types whether machine printed or handwritten. This includes things like bodies, PDFs, Tables, Excel Sheets, Acord forms, Loss Runs, SOVs, Images, zip files and even handwriting.

Indico data offers agents, workflows and integrations out of the box. Our workflows and agents cover 120+ product lines trained on over 20,000 insurance-specific data points that support 70+ languages across more than 900 insurance document types.

Yes! If you are using our out of the box agents, you have the full ability to tune prompts to fit your data best if you’d like. If you want full customizability, you can create your own agents which will be built upon your own schema and your own prompts.

You can use the OOTB agents as a foundation to build custom agents that include additional (or fewer) data points. This includes creating and modifying your own prompts for the revised data schema.

Yes, embedded documents along with emails attached to emails (and their accompanying attachments) are supported.

Yes

Our technology is transparent and offers full traceability. Any piece of data and action taken either with humans or with agents can be sourced to origin.

Yes, Indico Data supports extraction from Loss Runs and Statements of Values (SOVs). These pre-trained models are part of Indico’s extensive library of over 80 models, which can be used directly or further customized to meet specific business needs. This allows insurance companies to quickly deploy and benefit from advanced document processing capabilities without the need for extensive setup or training.

No. In fact, one of the things that customers love most is that there is no coding or technical elements involved in getting agents or workflows into production.

Enterprise customers typically achieve production for their first use case within 6–12 weeks, supported by our proven 97% production success rate. This timeline underscores our commitment to delivering successful outcomes and enabling straight-through processing with minimal human intervention. Our tailored delivery model ensures a balance of speed, accuracy, and scalability. Once live, expanding to additional use cases or lines of business is seamless and much faster.

Yes. We encourage customers to engage with us in a proof of concept or a pilot in order to help you better evaluate our product and see how it enables you to meet your business goals.

Indico Data can connect to any upstream system of your choice. For most of our customers, we pull data from an email inbox but we also have out of the box connectors with Box, ImageRight, Azure Blob, AWS S3 Bucket and Documentum as well as data enrichment tools like Relativity6 and Smarty.

Indico Data can connect to any downstream system of your choice. We are prepared to ensure seamless integration with your existing technology tools and have in-depth experience with this. Some out of the box options we have include Guidewire, SalesForce, Duck Creek, OneDrive, SQL, Snowflake, UiPath, Automation Anywhere and Blue Prism

If there is an API that is available, Indico Data can pull in additional data that is external to your systems. Also, custom components can be created to enrich the data with external APIs.

It depends. Our Submissions Ingestion Solution is a passthrough solution meaning data is always in your hands, not ours. Our Underwriting Clearance & Triage Solution does persist data for a period of your choosing.

Indico Data is typically hosted and managed by Indico Data and can be deployed in the client’s region of choice. Customers do have an option to host their own instance of Indico Data based on environment specifications provided by Indico Data.

No. Each environment is a single tenant and completely separate at the account level and dedicated to a specific customer.

Our pricing is based on the number of submissions you process each year and specific settings such as number of users and admins. Our pricing is custom for each customer based on your specific size and needs. Please contact our sales team for detailed pricing.

Indico Data offers 24/7 Assistance. Customers have access to round-the-clock support to address any issues or queries promptly.

Indico provides support through various channels including phone, email, and live chat, ensuring flexibility and convenience for customers.

Yes. We have a dedicated team focused on ensuring you get into production successfully. In fact, many customers choose us thanks to our 97% success rate of getting customers into production. We can also work with your existing system integration partner(s) or provide a referral.